Now that fall is upon us, the District of West Vancouver will be starting the budget process that will result in residents being informed of their property tax increase for 2025 sometime in Q1 2025. Public consultation will likely take place sometime in January 2025.

Many residents of West Vancouver are seniors (29%) who have modest or fixed incomes. They are facing significant cost increases for basics like food, shelter, heating and gas. On top of this it seems every level of Government are making the situation worse by increasing taxes. Municipalities like West Vancouver are no different as you will see below.

In setting guidelines for management in preparing the 2025 Budget, hopefully the Mayor and Council will direct them to keep any further tax increases to an absolute minimum and to do so by proactively seeking ways to reduce costs.

BACKGROUND

Property Taxes

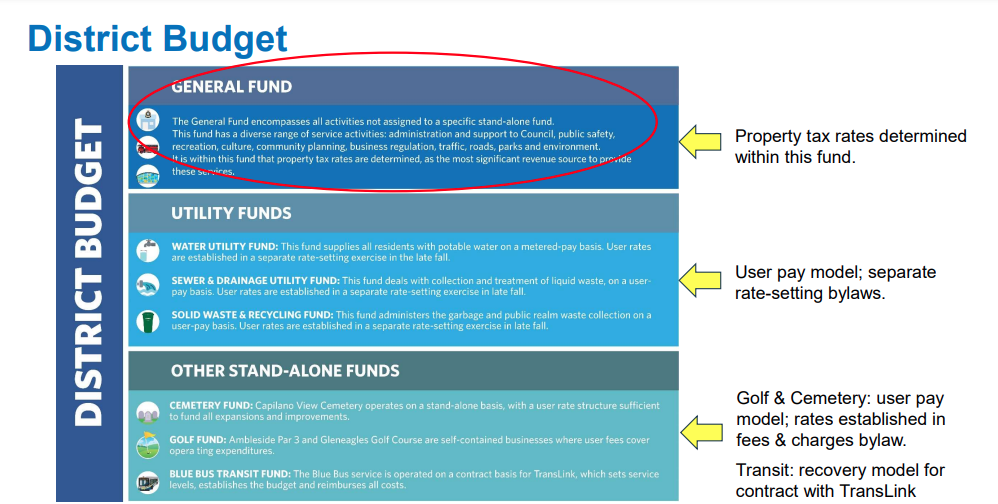

As a refresher the District of West Vancouver costs (excluding utility costs) make up around 45% of your total property tax bill. The Balance of 55% is made up of a School levies (including the “Education Tax”) 45%, Transit levy 7% and Regional District 3%. The District of West Vancouver has little control over these costs that are downloaded to West Vancouver property taxpayers. These various levies have continued to increase at rates well above inflation for many years.

The West Vancouver costs (the 45%) are largely broken down as follows- Fire & Rescue 22%, Police 21%, Asset Levy for maintenance and renewal of assets 16%, General Government 16%, Parks, Culture & Community services 13%, Library 6% and Transportation 6%. The District of West Vancouver employs roughly 800 permanent employees and salaries and benefits

costs make up approximately 55% of the costs.

Utility Costs

Residents are billed separately for Utilities which include water, sewage, storm drainage and solid waste based largely on usage or estimates thereof. These costs make up approximately 40%-50% of your property tax bill and have increased well above the rate of inflation for many years.

This bill will increase even more as the charges for the new $3.9 billion North Shore Wastewater Treatment plant (original estimate was $700 million) are added to your utility or property tax bill. It is estimated the cost per household will be an additional $590 per year for the next 30 years (resulting in a doubling of sewage costs).

PAST YEARS

Between 2017 and 2023, total costs controlled directly by the District (the 45%) were up around 30% compared to inflation of around 20%. During that same period, the number of District employees rose by 6% while population remained largely flat.

In 2024, property taxes were increased 7.54%. 3.54% for Operating and 4.00% for the Asset Levy. This was well above the rate of inflation of 3.9%. There was also an 8% increase in Utility Costs (that are largely regional costs allocated to West Vancouver).

Asset Levy

The Asset Levy charged for maintenance and renewal of assets has increased from $7.4 million in 2017 to $19.8 million in 2024. Meanwhile during this time frame (2017 to 2023) Cash & Investments have increased from $135 million to $305 million ($17,200 per household) and Net Financial Assets from $23 million to $135 million ($7,600 per household).

While it is admirable that the District has built up significant financial reserves, perhaps consideration in 2025 could be given to how perhaps some of these reserves may be used to moderate or avoid future Asset Levy increases.

Written by Graham McIsaac, ADRA Director